Event date: 01-11-2023

Event Time: 1:00 PM

Venue:Online via Zoom

If you are a CEO or a CFO of a high growth startup, it is vital to understand how to value your company correctly. An IRS Section 409A valuation is an independent appraisal of the fair market value (FMV) of a private company’s common stock that determines the “strike price” for equity. If your company is planning to offer options, you’ll need a 409A valuation. Here is a quick list of questions this workshop will help you answer:

Do you offer or are you planning to offer your employees stock options?

Do you know the difference between ISOs and non-ISOs?

Do you understand the general valuation concepts and approaches that the IRS has outlined, especially as they apply to early-stage companies?

Did you know that if you run afoul of the 409A rules, your employees could have an unpleasant tax surprise and that some of that responsibility could revert back to you as the employer?

Do you know if and when you need to engage an outside expert to assist with a valuation?

If you need answers to any of these questions, join us for our workshop where a comprehensive document will also be provided to guide you through this process.

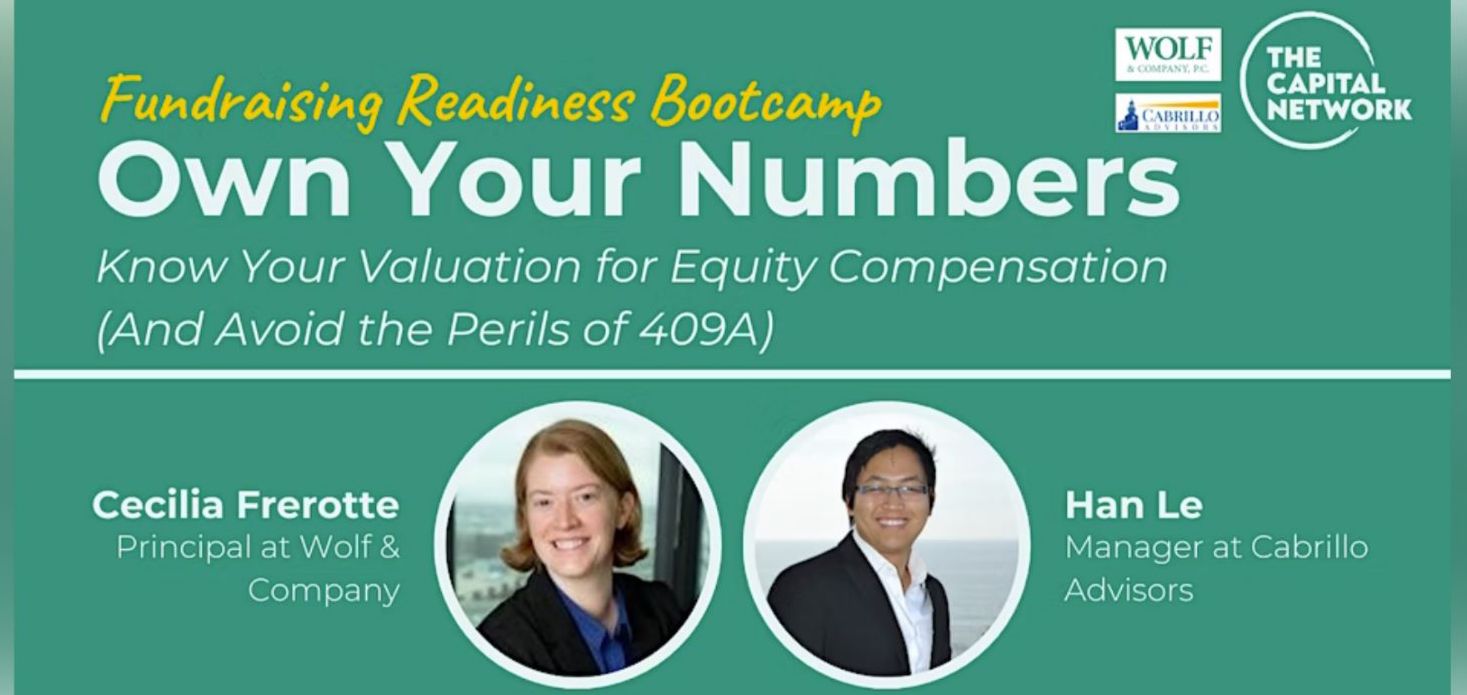

Speakers:

Han Le: Manager at Cabrillo Advisors

Cecilia Frerotte: Principal at Wolf & Company